Simplify Tax Season: QuickBooks for Expense Tracking and Financial Organization

Mar 25, 2025Okay, I'll be honest, I was resisting using bookkeeping and tax software for years and just was sticking to my cozy Google Sheets file. Then I'd spend another 3-4 hours every January trying to properly categorize every income and expense transaction. And even after that, my CPA would still have a ton of questions, and I'd basically go into a never-ending vicious cycle. So do yourself a favor, spend 5 minutes to read this article, and get an account with QuickBooks that will save you time and money for years to come!

Get Your Finances in Order!

Staying organized with your finances is not just good practice, it's essential for a smooth tax season and running your business effectively. QuickBooks acts as a central hub, offering various tools to help you manage your financial data. For example, you can download your bank statements directly within QuickBooks. No more logging into separate banking websites – you can access those important records easily for reconciliation and tax documentation.

You can also attach relevant documents, like invoices and contracts, directly to transactions in QuickBooks. This keeps all the information related to a specific financial activity together in one easy-to-find place, creating a clear audit trail and making it simpler to retrieve information if you ever need it for tax audits or just your own review.

QuickBooks offers a wide variety of customizable financial reports. These include the big ones like your Profit and Loss statement, Balance Sheet, and a summary of your expenses by vendor, giving you valuable insights into how your business is doing. Importantly, QuickBooks also has tax-specific reports that can really help with the preparation process. These reports present your financial data in a way that makes it easier to understand your business performance and get your tax filings right.

The QuickBooks App Store is another great way to boost your organization by letting you connect with tons of other business tools. This integration helps data flow smoothly between different platforms, giving you a more complete picture of your business operations and keeping important information all in one place.

Being a cloud-based platform, QuickBooks Online gives you the huge advantage of being able to access it from anywhere you have an internet connection. This is super handy when you're working on those last-minute tax preparations or just managing your finances on the go, giving you the flexibility to get to your financial data whenever and wherever you need it.

Ultimately, QuickBooks acts as a central, well-organized place for all your financial data. This makes it so much easier to find, manage, and use the information you need for tax preparation, especially when time is tight, and for keeping your business finances on track in general.

Your Last-Minute Tax Prep Friend - QuickBooks

When that tax deadline is breathing down your neck, every minute counts. QuickBooks has some really smart features that can speed things up. For instance, you can get unlimited digital signatures with Intuit Sign for Pro Tax. No more printing, scanning, and mailing forms – you can get those signatures quickly and easily online. Plus, it timestamps everything and keeps those documents safe for seven years, which is a nice little bonus for peace of mind during a hectic time.

Let's be honest, nobody wants to make mistakes on their taxes. QuickBooks has your back with its built-in Active Auditor. This clever tool searches for errors, sorting them by how serious they are so you can fix the important stuff first. It even points out potential problems as you go and tells you how to correct them. Think of it as a virtual spell-checker for your taxes, helping you avoid delays or complications caused by typos or miscalculations, especially when you're rushing to meet a deadline.

Manually typing in all your financial info? Ugh, talk about a time-suck, especially when you're trying to beat the clock with your taxes. QuickBooks solves this by letting you securely connect your bank and credit card accounts and automatically import your transactions. This means you can say goodbye to hours of manual data entry. What's even better is that QuickBooks can automatically sort these imported expenses into categories, which is a huge help when you're trying to figure out what you can deduct. You can even set it up to suggest categories for you to review, and for those recurring expenses, you can create bank rules to make sure they're always categorized correctly. This automation can seriously cut down the time you spend getting your financial ducks in a row for tax season.

If you're self-employed, QuickBooks has a neat "Books to Tax" feature, including something called T2125 self-employed tax mapping. Basically, it lets you link your bookkeeping categories directly to the right spots on your tax forms, specifically the T2125 form for your self-employment income and expenses. This direct link means you don't have to manually transfer info between different systems, saving you precious time and reducing the chance of errors. And when it's time to actually file, QuickBooks plays well with popular tax software like TurboTax, letting you export your financial data directly for an even smoother process.

Finally, QuickBooks makes it easy to pull up those essential financial reports, like your Profit and Loss statement and your Balance Sheet. These reports give you a clear, quick snapshot of your income and expenses, providing the overview you need for accurate tax reporting, even when you're short on time.

Bottom line? QuickBooks brings all your financial info together in one place and gives you a set of tools that really speed up the tax preparation process. This is a lifesaver when you're facing a tight deadline because it means you're not juggling a bunch of spreadsheets, paper documents, and manual calculations.

Say Goodbye to Receipt Piles!!!

Let's face it, tracking expenses can feel like a chore. But it's super important for both keeping your business finances healthy and making sure your taxes are accurate. QuickBooks makes this way easier with some smart automation. When you connect your business bank accounts and credit cards, QuickBooks automatically pulls in your transactions. This means you've got a complete record of your business spending without having to manually enter everything.

The receipt capture feature is another game-changer. Using the QuickBooks mobile app, you can just snap a photo of your receipts. The software is smart enough to pull out key details like the vendor, amount, and date, and it can even automatically match the receipt to a transaction you already have recorded. You can also upload receipts from your computer or email them directly to QuickBooks if that's easier. This means no more shoeboxes overflowing with crumpled receipts – you can record your expenses instantly from anywhere.

QuickBooks also takes the pain out of categorizing expenses. The system can learn how you usually categorize things and apply those rules automatically. You can also create your own rules for those recurring expenses, making sure everything is categorized consistently and accurately. This is super important for figuring out what you can deduct from your taxes and getting those financial reports right.

For those of you who use your car for business, QuickBooks has an automatic mileage tracking feature in its mobile app (my favorite feature!!!) It uses GPS to track your business miles, and you can easily mark trips as business or personal. Keeping accurate mileage logs is key for claiming those mileage deductions on your taxes, and this feature takes away the hassle of doing it manually.

By automating these key parts of expense tracking, QuickBooks saves you a ton of time and effort. It also helps you avoid losing receipts and potentially missing out on tax deductions, giving you a clear and organized view of your business spending, which is especially helpful when you're trying to get your taxes done quickly.

Save Money and Get Expert Help with QuickBooks

By signing up for QuickBooks through this exclusive partner link, you can snag a 30% discount for the first 6 months of your subscription!

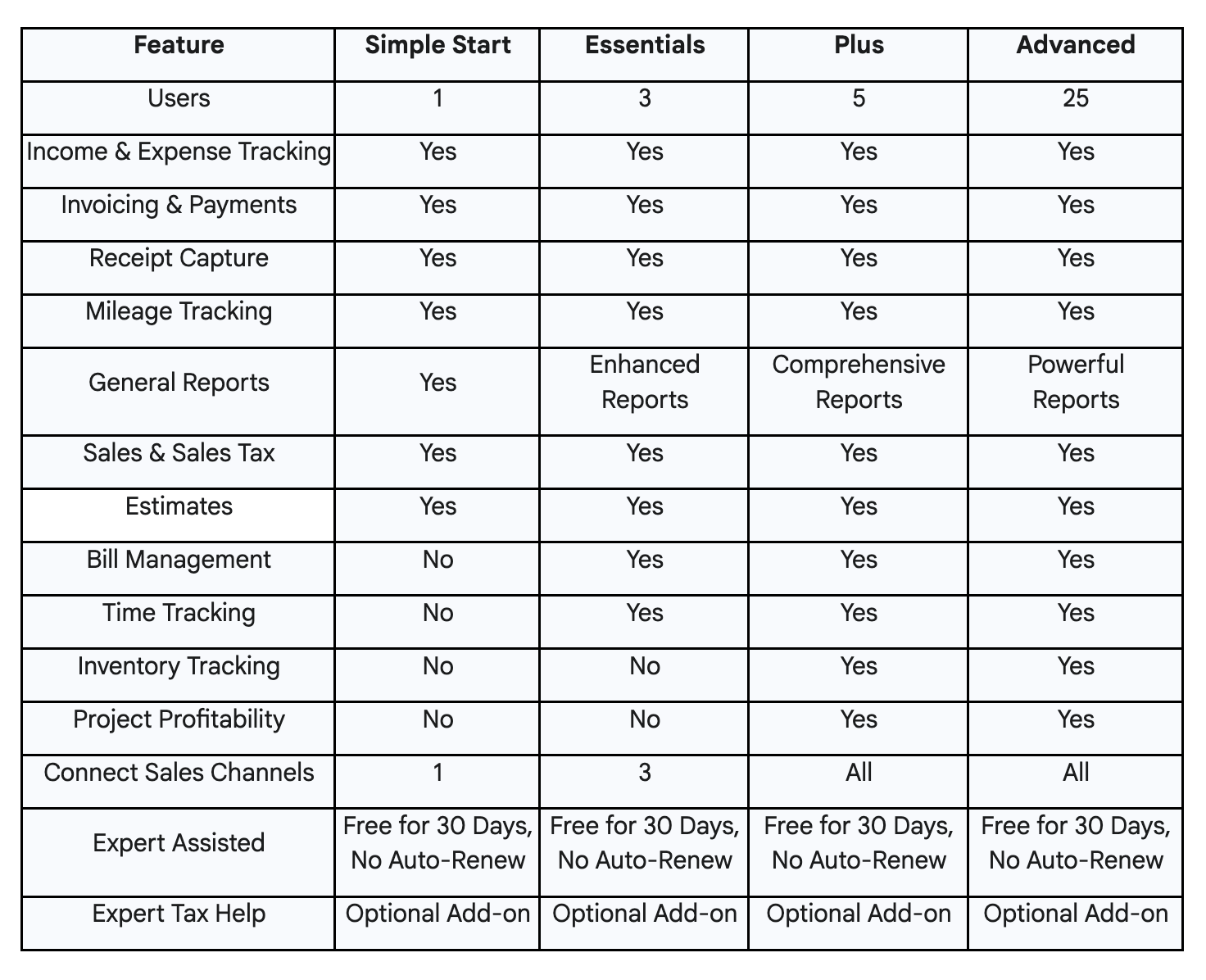

QuickBooks Online has different plans to fit various business needs, including Simple Start, Essentials, Plus, and Advanced. Take a look and see which plan makes the most sense for your business, and then enjoy those savings for the first half-year. Again, if you are more of a Solopreneur, just switch to the "For Solopreneur" tab to get started!

With your new account, you'll also get 30 days of QuickBooks Live Expert Assisted! You get one-on-one help from QuickBooks-certified experts through video calls. They can help you get your QuickBooks account set up, give you tips on good bookkeeping practices, help you categorize your transactions correctly, walk you through reconciling your accounts, and answer any questions you might have. It's a fantastic way to get personalized support and make sure you're getting the most out of QuickBooks right from the start.

To help you figure out which plan is right for you, here's a quick rundown of some of the QuickBooks Online options:

TLDR;

Plenty of small business owners and freelancers have already discovered how much easier QuickBooks makes tax preparation. You'll often hear in blog posts and articles about the significant time savings they've experienced. Many users talk about how much better organized their finances are, leading to a much less stressful tax season. The fact that QuickBooks helps reduce errors with its automated features and built-in checks is another big plus that people mention. Overall, QuickBooks users often feel more confident about managing their finances and getting ready for tax time. I've experienced it first-hand! What a relief!

It's your turn to try it!

Affiliate Disclosure: This post may contain affiliate links, and I make earnings from some qualifying purchases if you click the links. I only recommend tools and products that I personally use and trust!

Lead Magnet Essential Checklist

A vital 5 x 5 formula for creating your Lead Magnet to grow your email list and build a foundation for your future offers

Grab this FREE checklist to create your first (or next) glamorous lead magnet and start building your email list while you sleep + learn 5 essential nitty-gritty tech pieces to have in place for a seamless lead onboarding process!

Just enter your information in the box and get instant access to the checklist download.

By submitting this form, you agree to receive this free checklist and be added to our mailing list for future communication. Your information is safe and will not be shared with a third party. Unsubscribe anytime.